Theme 3a

Aerospace Sector

The Aerospace Manufacturing Sector

The Aerospace Manufacturing Sector

Key UK aerospace manufacturing trends in the last decade

- Value added for UK aerospace manufacturing experienced a fall between 2006 and 2015, followed by a partial recovery until 2021. The UK ranked third among OECD member countries for aerospace manufacturing by value added in 2019, behind the US and France.

- Value added for maintenance, repair and operations (MRO) has decreased by around two-thirds since 2010. MRO value added had previously remained stable between 1990 and 2010.

- A decrease of 14,000 employees was observed in 2020–21 for aerospace manufacturing. Employee numbers had remained stable at around 90,000 employees between 2012 and 2020.

- Labour productivity in UK aerospace manufacturing increased between 2012 and 2021. Sector productivity is the third highest in the OECD, behind France and the US.

- The UK has one of the highest aerospace trade surpluses among comparator countries. The UK was the third largest net exporter of aerospace products in 2021, with a surplus of US$14.7 billion.

- UK business R&D expenditure grew steadily between 2010 and 2019. The sector spent 37% more in 2019 than it did in 2010, compared to increases of 199% in Japan and 15% in Italy. The US and Germany had negative growth, while France remained stable.

Drivers identified in literature review and sector expert consultations

Value added and productivity

- The aerospace market is typically cyclical and sensitive to global crises, with the cycles closely linked to global economic performance.

- Long-term order and contract pipelines shape investment planning and add resilience to the sector.

- Demand from a handful of mostly foreign-owned OEMs has a significant effect on the whole UK aerospace supply chain, while investment decisions are often made abroad.

- Company restructuring and supply chain consolidation were responsible for the recent fall in the number of sector employees.

- Workforce know-how and closeness to leading R&D hubs anchors operations to the UK.

- Competitive challenges and opportunities driving policy and industrial strategies include the market shift towards single-aisle aircraft, competition from low-cost economies, domestic supply chain development needs, trade restrictions, geopolitical issues, and input cost pressure on margins.

Trade

- The UK’s specialisation in engines and aircraft components drives its high exports.

R&D and innovation

- Sector competitiveness is underpinned by its advanced R&D and innovation capabilities.

- Government is a key enabler of sectoral R&D, innovation and competitiveness.

- Continuous investment in innovation will be needed to seize the opportunities arising from emerging market and technology trends such as the transition from fossil fuels to zero-carbon aircraft, the emergence of new aircraft segments, industrial digitalisation, and space tourism.

Aerospace manufacturing – value added and employees

Note: [1] United Kingdom employee data for 2018. [2] OECD provides the value added for each country in its national currency; these were converted into USD by referring to annual exchange rates provided by OECD.

Source: OECD STAN, ISIC4, Code D303 – air and spacecraft and related machinery; OECD, MEI, exchange rates (USD monthly averages). Accessed February 2023.

- Based on OECD data, the UK ranked third among member countries for aerospace manufacturing by value added in 2019. This is roughly 10 times lower than the value added reported by the United States at the top of the ranking.

- France takes second place in this ranking, with total value added of US$18.3 billion, while Germany ranks just below the UK with a value added of US$12.6 billion.

- The UK has the second-largest number of employees among top-performing countries, at 86,900 employees, below the United states (533,000) and above Germany (86,000) and France (64,000).

- France reported the highest level of productivity, measured by value added per employee (US$285,900), followed by the US (US$251,600) and the UK (US$149,600).

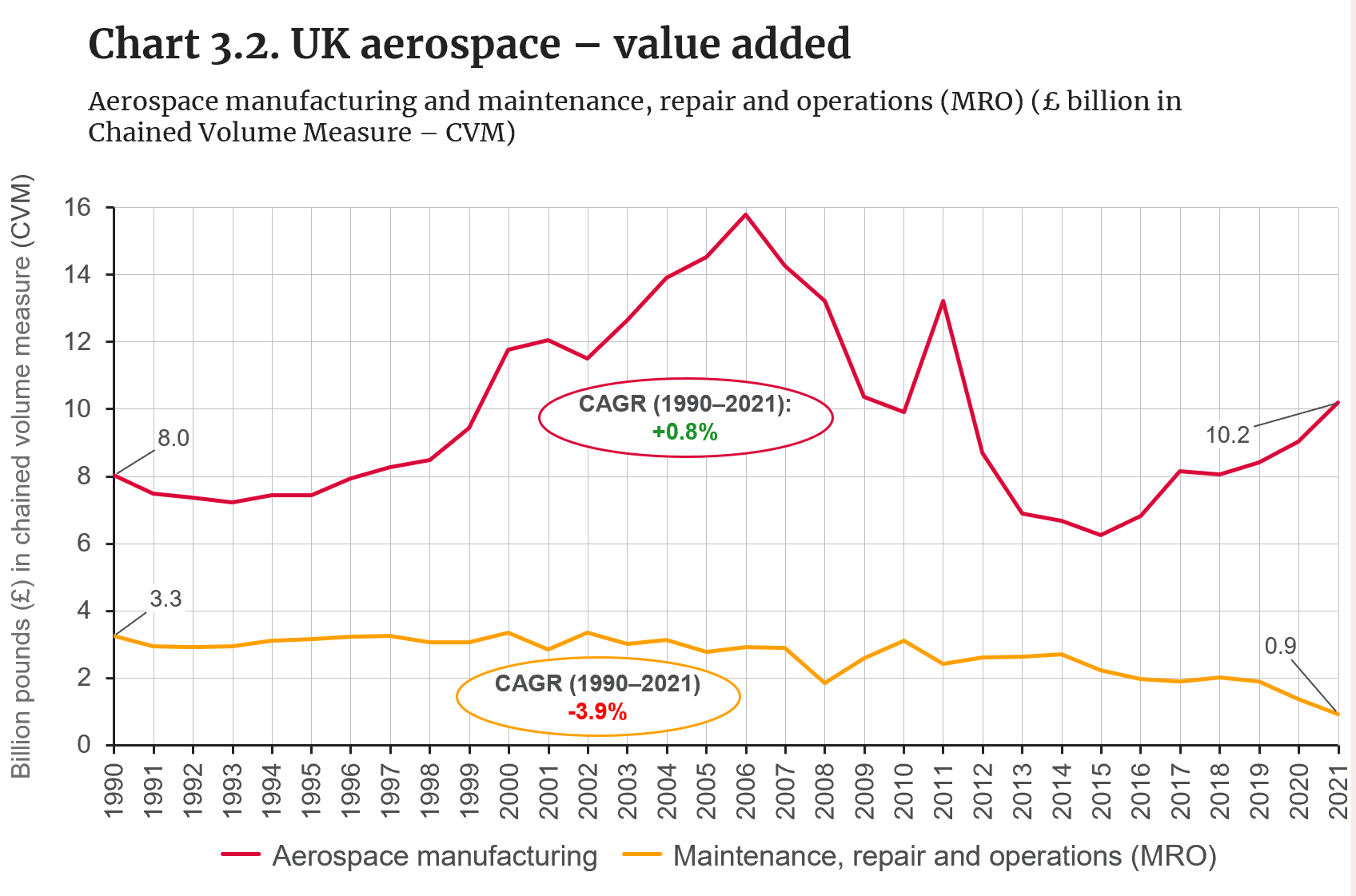

UK aerospace – value added

Source: ONS, GDP output approach – low-level aggregates (updated version: 22 December 2022); aerospace manufacturing (SIC 2007 Code 3030 for the manufacture of air and spacecraft and related machinery), MRO (SIC 2007 Code 3316 for the repair and maintenance of aircraft and spacecraft).

- According to ONS data, value added for UK aerospace manufacturing experienced a fall between 2006 and 2015, followed by a partial recovery between 2015 and 2021.

- Value added for maintenance, repair and operations (MRO) remained stable between 1990 and 2010, despite a short-term decrease during the 2008 financial crisis. MRO value added decreased by around two-thirds after 2010, reaching £0.9 billion in 2021, compared to £3.3 billion in 1990.

- As suggested by consulted stakeholders, the demand for air travel drives the demand for aircraft, and this can easily be disrupted by external events.

- For example, the demand for aircraft fell as a result of the 2001 global economic slowdown, further affected by events such as the conflict in the Middle East, the SARS crisis in Asia and the 9/11 terrorist attacks [House of Commons, 2005].

- The 2008 financial crisis generated a lower impact in UK aerospace manufacturing, potentially due to a combination of government support and historically large order books from the larger manufacturers [House of Commons, 2017].

- Data from civil aircraft manufacturers shows that both Boeing and Airbus had fewer aircraft deliveries during the COVID-19 pandemic, although this trend started to recover in 2021 [JADC, 2022].

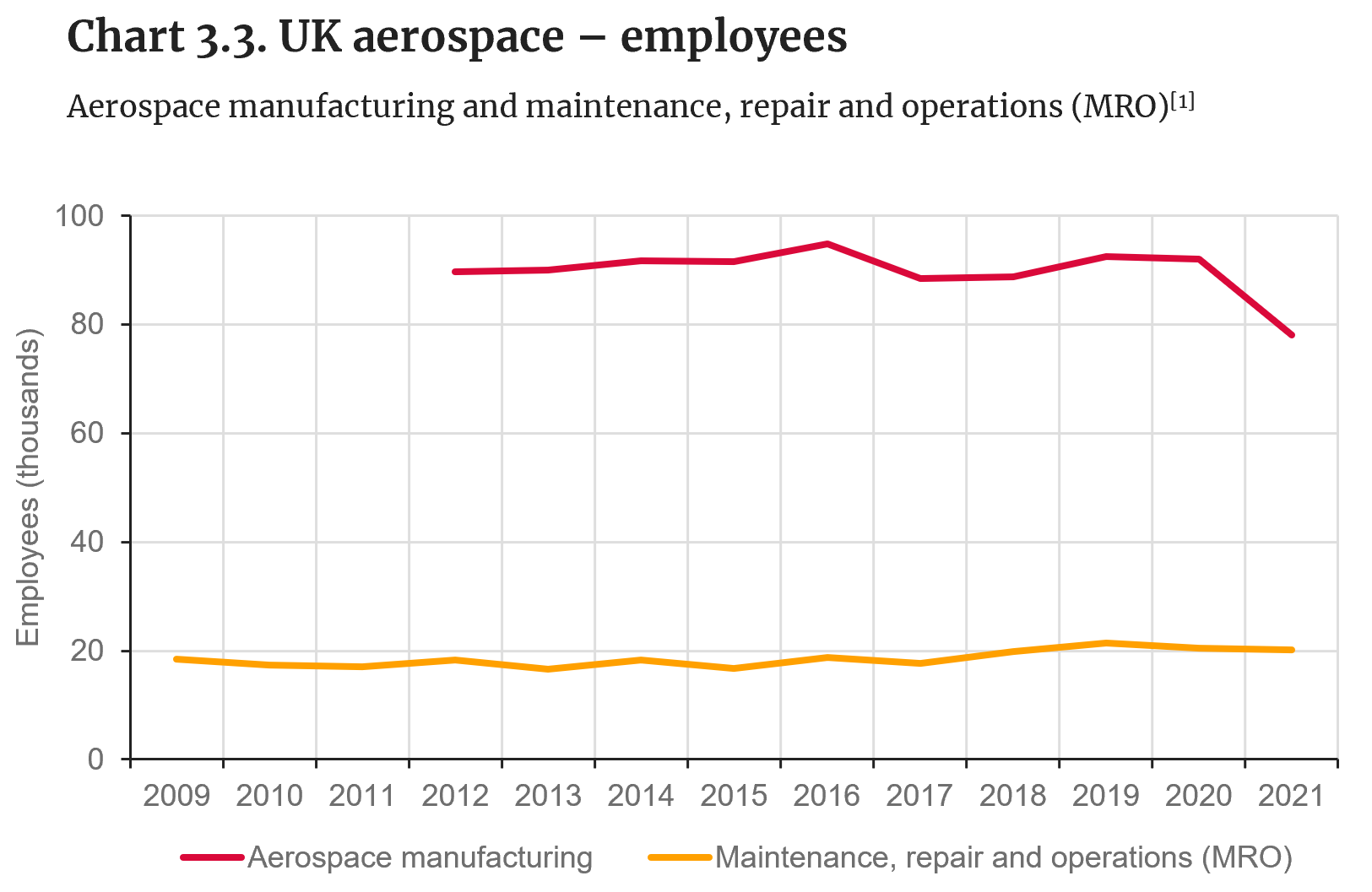

UK aerospace – employees

Note: [1] Data for aerospace manufacturing is at UK level; data for MRO is at GB level.

Source: ONS, Business Register and Employment Survey (BRES) in thousands; aerospace manufacturing (SIC 2007 Code 3030 for the manufacture of air and spacecraft and related machinery), MRO (SIC 2007 Code 3316 for the repair and maintenance of aircraft and spacecraft). Accessed February 2023.

- The number of employees in the UK’s aerospace manufacturing sector remained stable at around 90,000 employees between 2012 and 2020.

- The number of employees in maintenance, repair and operations (MRO) saw little change between 2009 and 2021, remaining just below 20,000 employees until 2019.

- A decrease of 14,000 employees was observed in 2020–21 for aerospace manufacturing, attributed by the consulted stakeholders to redundancies in OEMs such as Airbus and Rolls-Royce, among others, due to company restructuring associated with lower production levels during the COVID-19 pandemic in 2020–21 [BusinessLive, 2021; BBC, 2020].

- Despite OEMs cutting jobs in response to external events, the impact on direct employment is potentially limited, as firms aim to retain their skills base and manufacturing capacity. For example, Airbus’ 2021 revenue was 30% below that realised in 2019, but its workforce was only 15% smaller [Airbus, 2022].

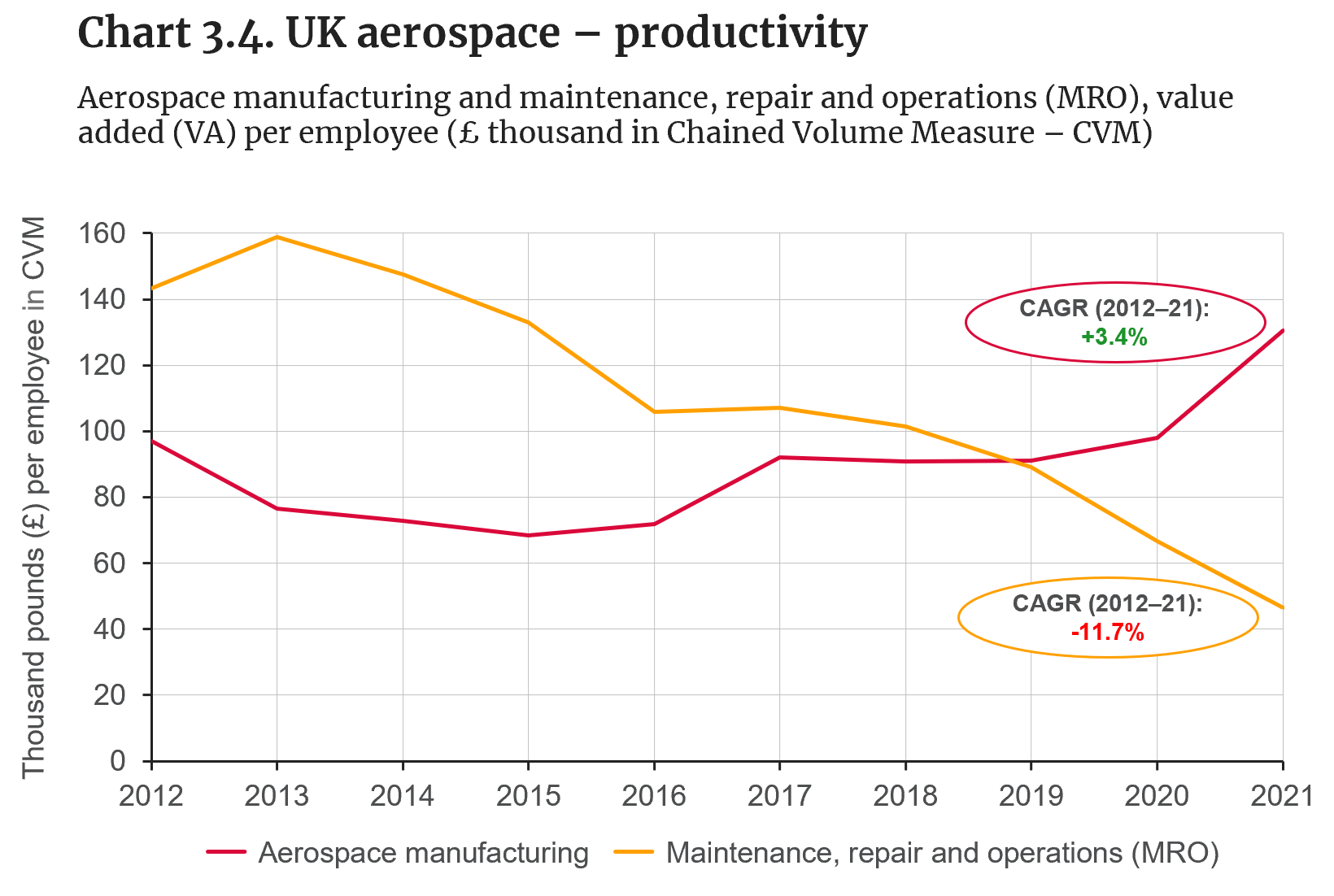

UK aerospace – productivity

Source: ONS, GDP output approach – low-level aggregates (updated version: 22 December 2022), ONS, Business Register and Employment Survey (BRES); Aerospace Manufacturing (SIC 2007 Code 3030 for the manufacture of air and spacecraft and related machinery), MRO (SIC 2007 Code 3316 for the repair and maintenance of aircraft and spacecraft).

- Based on the value added and number of employee trends observed in Charts 3.2 and 3.3, the following productivity trends can be observed (measured in value added per employee):

- Productivity in maintenance, repair and operations (MRO) activities in the UK decreased between 2012 and 2021, presenting a compound annual growth rate (CAGR) of -11.7% during this time period.

- In contrast, productivity in aerospace manufacturing increased between 2012 and 2021, with a 3.4% CAGR, from a lower baseline in 2012 compared to MRO.

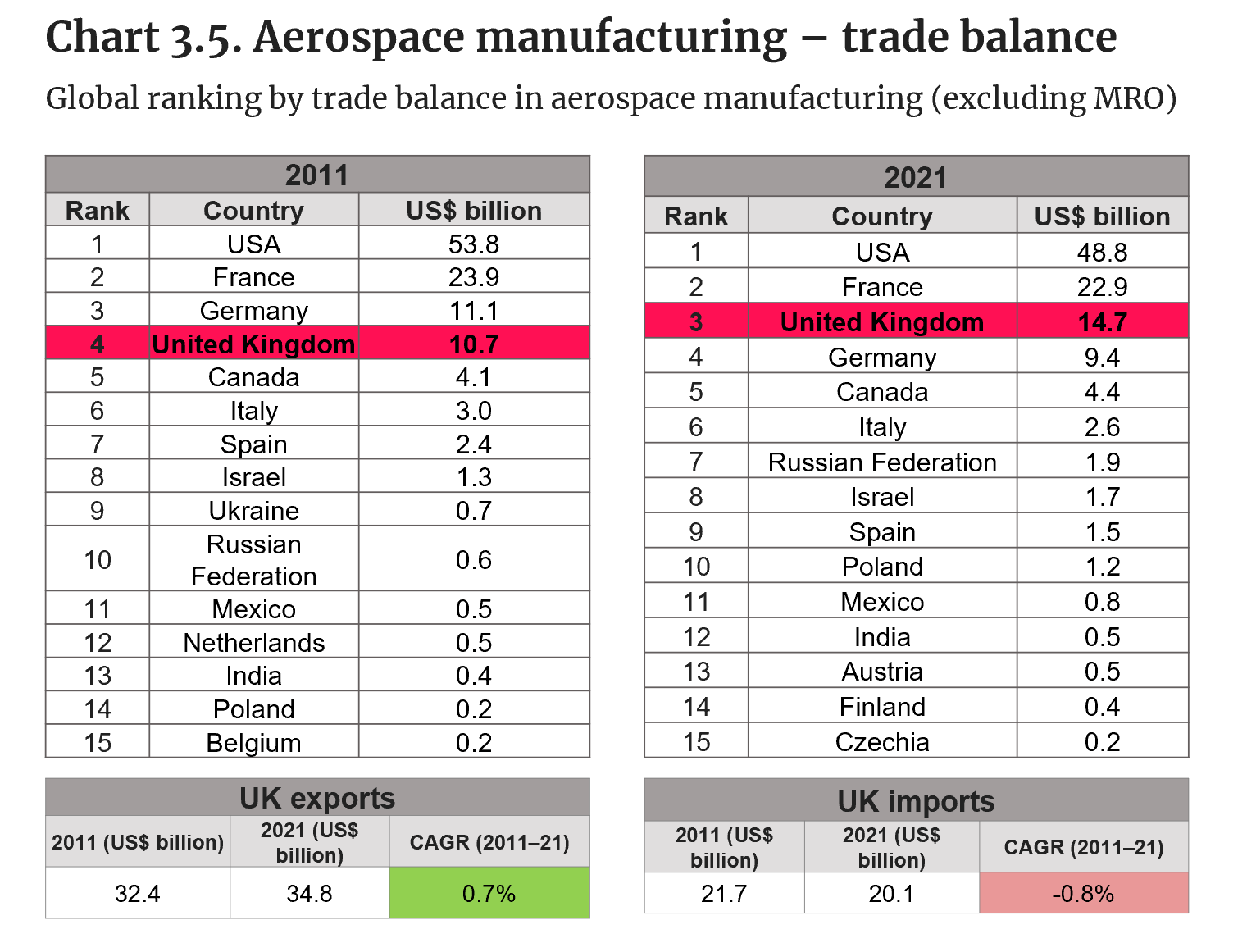

Aerospace manufacturing – trade balance

Source: UN Comtrade (accessed in December 2022), HS 2017. Aircraft, spacecraft and parts thereof (Code 88); aircraft engines and parts thereof (Code 840710, 840910, 841111, 841112, 841121, 841122, 841191, 841210); aircraft seats and parts thereof (Code 940110).

- The UK maintained its trade competitiveness in aerospace products from the perspective of trade balance over the 2011–21 period.

- The UK moved up in the ranking as a net exporter of aerospace products, from fourth place in 2011, with a surplus of US$10.7 billion, to third place in 2021, with a surplus of US$14.7 billion.

- The top five net exporters coincide with the top five manufacturers presented in Chart 3.1.

- The improvement of the UK’s position in the trade balance ranking is driven by a slight increase in exports (US$2.4 billion) and a small decrease in imports (US$-1.6 billion) between 2011 and 2021.

- The UK’s specialisation in engines and aircraft parts is reflected in exports, accounting for 79% of all UK aerospace overseas sales in 2016 (with 35% of those parts being wings, fuselage, doors, control surfaces, landing gear and fuel tanks, 23% being turbojet engines and 20% engine parts) [Make UK, 2019].

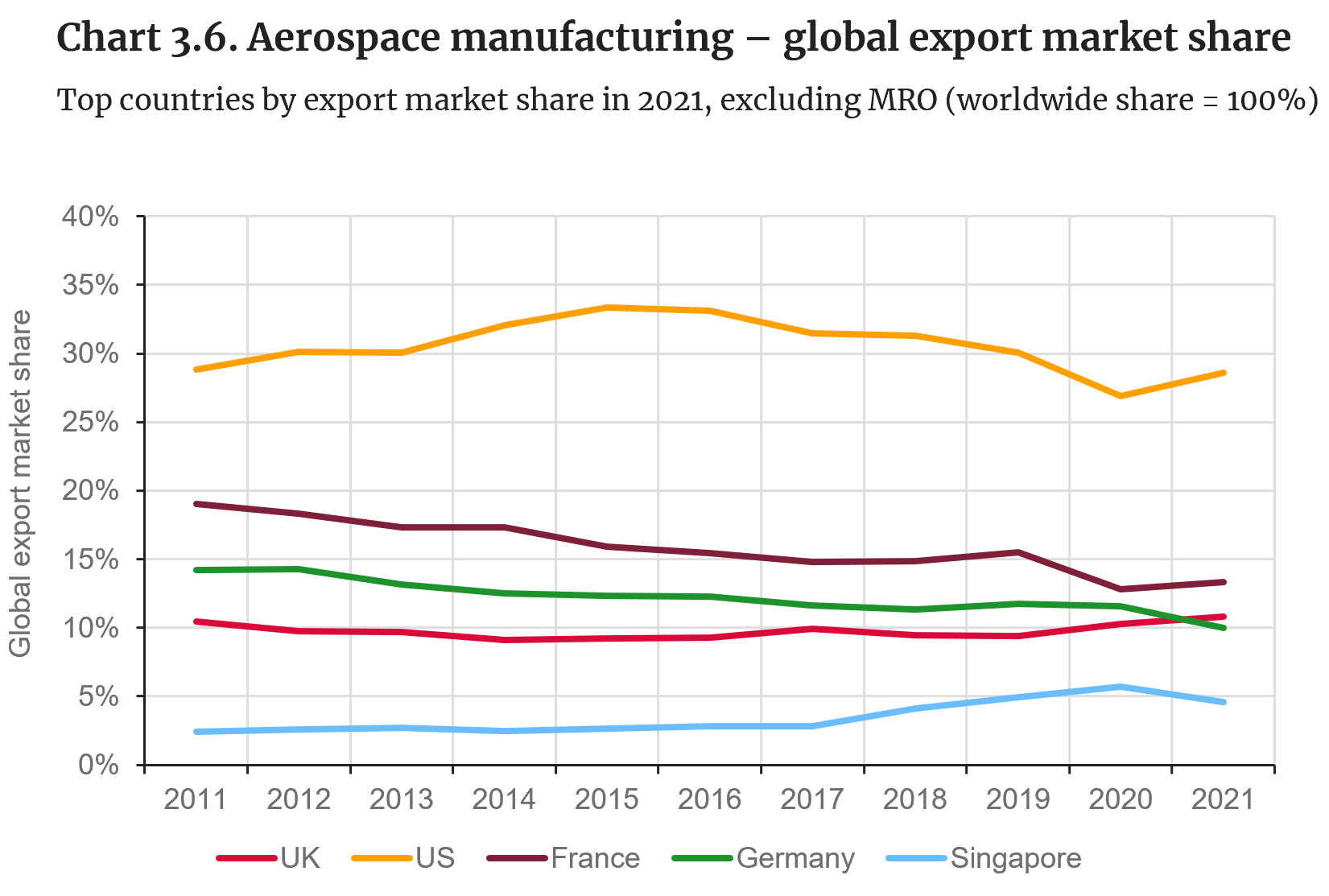

Aerospace manufacturing – global export market share

Source: UN Comtrade (accessed in December 2022), HS 2017. Aircraft, spacecraft and parts thereof (Code 88); aircraft engines and parts thereof (Code 840710, 840910, 841111, 841112, 841121, 841122, 841191, 841210); aircraft seats and parts thereof (Code 940110).

- The US had the largest aerospace products global export market share between 2011 and 2021, with a total share of 28.6% in the last recorded year.

- Although France maintained its second place during the same time period, it experienced a fall from 19% in 2011 to 13.3% in 2021.

- The UK surpassed Germany to occupy third place in this ranking in 2021, with a 10.8% export market share, while Germany’s share diminished from 14.2% in 2011 to 10% in 2021.

- Singapore’s export market share grew from 2.4% in 2011 to 4.6% in 2021, occupying fifth position in this ranking. Breaking down the aerospace product categories exported by Singapore, the value of aircraft engines was US$10.5 billion in 2021, accounting for 71.4% of the total value of its aerospace exports that year.

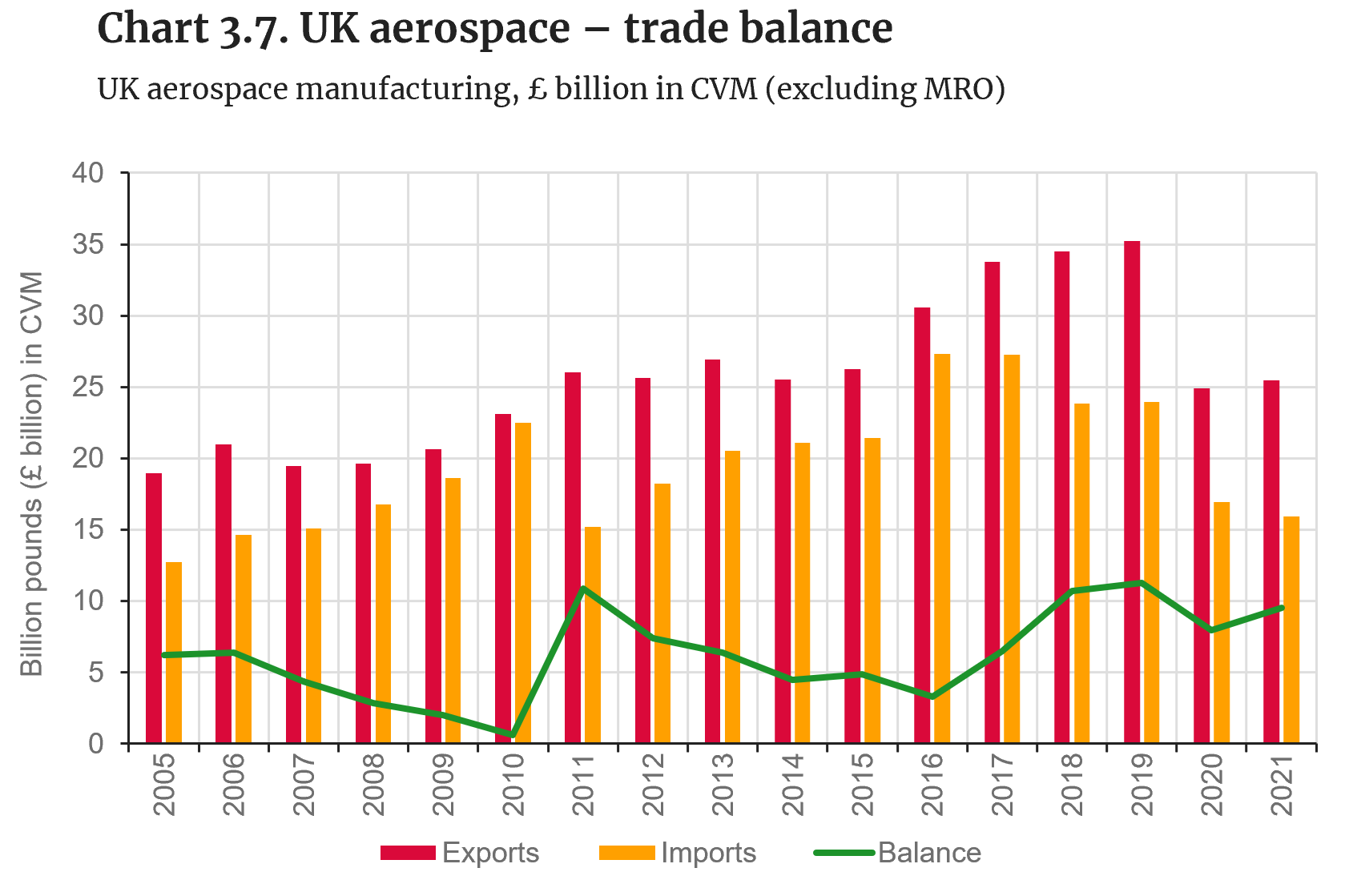

UK aerospace – trade balance

Source: ONS, UK trade in goods by classification of product by activity time series (updated version: 15 December 2022); aerospace manufacturing (SIC 2007 Code 3030 for the manufacture of air and spacecraft and related machinery).

- The UK recorded positive trade balances in aerospace products between 2005 and 2021.

- Despite two low points in 2010 and 2016, the UK recorded a more positive trade balance in aerospace products in 2021 than in 2005.

- The outbreak of COVID-19 hindered the positive trend in trade balance, which was driven by the reduction of imports and the growth of exports.

- Exports peaked in 2019, whereas the highest imports were recorded in 2016.

- The value of aerospace exports in 2021 (£25.46 billion) was lower than a decade before, whereas the value of aerospace imports in 2021 (£15.93 billion) was only £0.76 billion higher than a decade before.

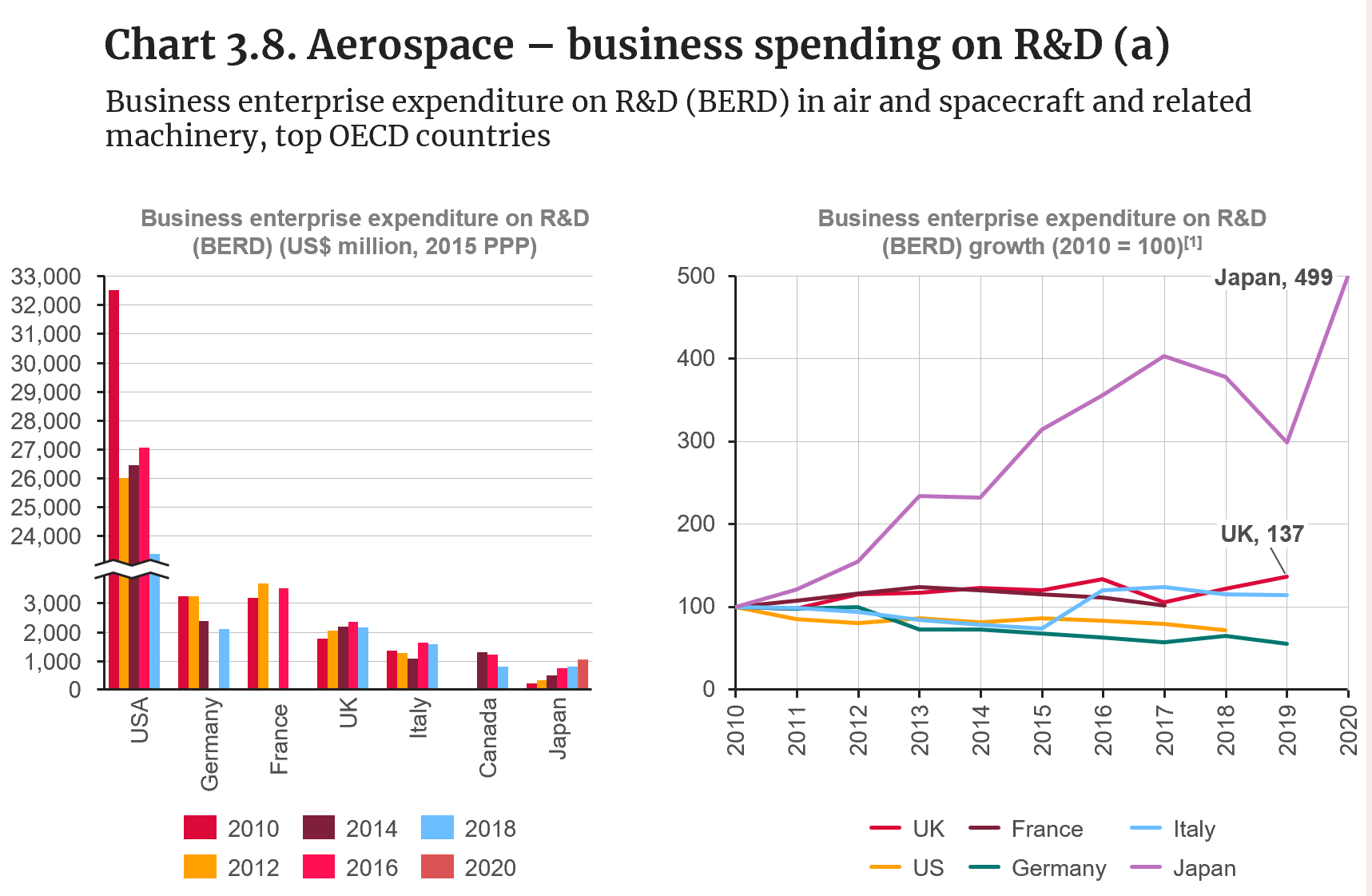

Aerospace – business spending on R&D (a)

Note: [1] Data for Canada starts in 2014 and has been excluded from the BERD growth chart on the right, which takes 2010 as the reference year.

Source: OECD Research and Development Statistics, ISIC Rev. 4, Code D303: air and spacecraft and related machinery. Accessed in March 2023.

- As suggested by the consulted stakeholders, UK aerospace is a high-value sector driven by innovation. The ability to innovate has ensured the international competitiveness of the sector by staying at the forefront of technological development.

- In absolute terms, business enterprise R&D expenditure in UK aerospace was the third highest in the OECD ranking in 2018, behind the US and France but ahead of Germany, Italy, Canada and Japan.

- The US maintains a dominant position with aerospace business R&D expenditure in a different order of magnitude than comparator countries.

- Using 2010 as the reference year, the UK had the second-largest growth in BERD among the examined countries in 2019 (37%). Japan had the largest BERD expansion in 2019 (199%), while Italy had the third-largest growth (14%). In contrast, the US and Germany experienced reductions in business R&D expenditure between 2010 and 2018–19, while France had near-zero growth in 2017 after a few years of positive BERD expansion.

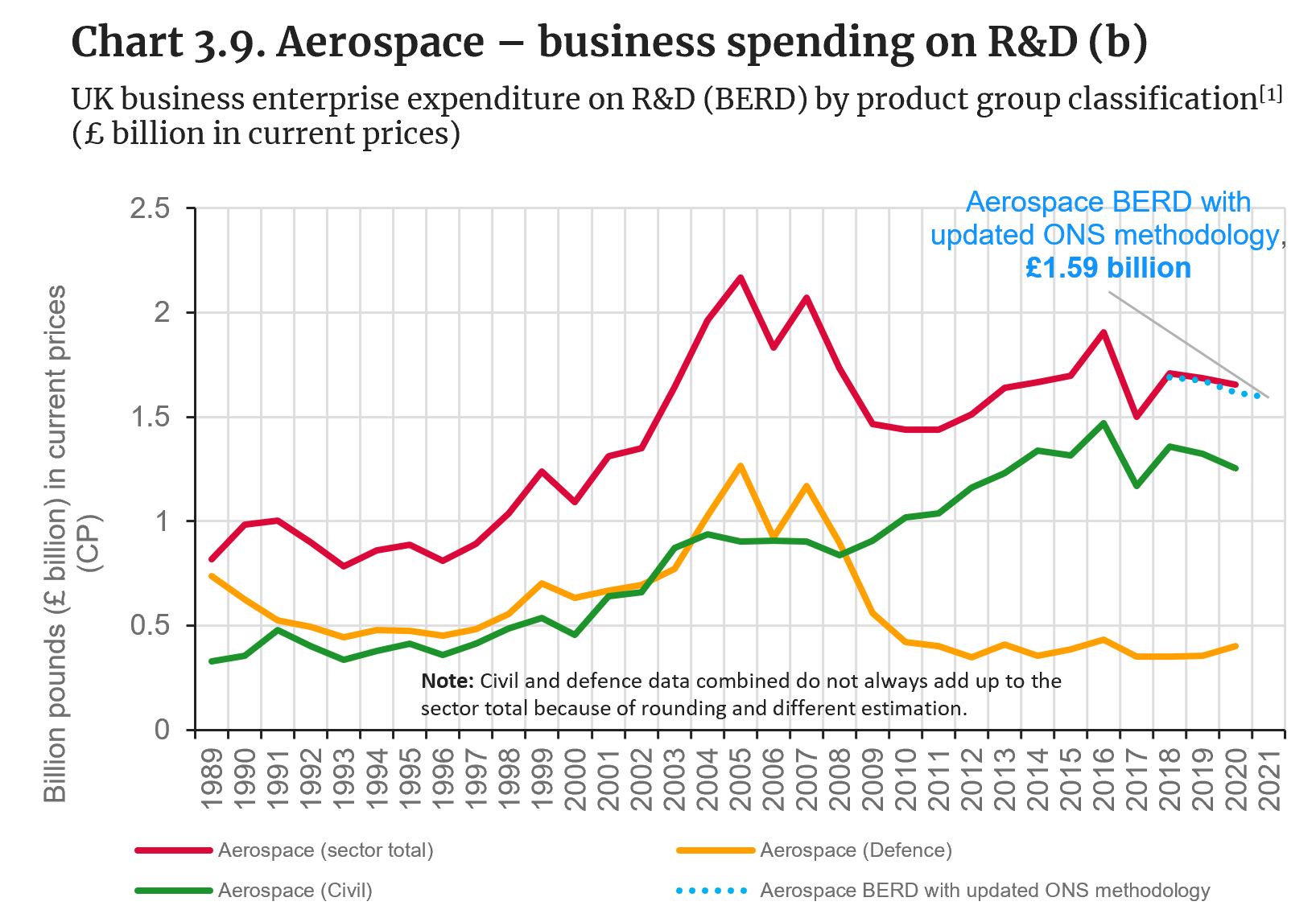

Aerospace – business spending on R&D (b)

Source: ONS, total intramural R&D – aerospace, total intramural R&D – civil aerospace, total intramural R&D – defence aerospace, business enterprise research and development, UK (designated as national statistics).

Note: [1] Developed by ONS, the term “product group” refers to business R&D expenditure allocated to the product group that best describes the subject type of R&D activities carried out by firms, rather than being based on the economic activities SIC classification.

- ONS sectoral BERD data by product group classification shows that there was an overall reduction in UK aerospace BERD between 2005 and 2010, mostly driven by a fall in defence BERD.

- BERD in defence aerospace diminished from £1.3 billion in 2005 to £0.4 billion in 2010, and has remained roughly stable after that.

- In contrast, BERD in civil aerospace has shown a positive trend since 2000, with the overall aerospace sector BERD trend (in red) mirroring the civil aerospace trend (in green) since 2011.

- ONS sectoral BERD data estimated with an updated methodology for 2018–21 shows a similar trend (dotted blue line) to data calculated using the previous methodology. The overall aerospace sector BERD was £1.59 billion in 2021.

What is driving value added, productivity and trade trends in aerospace manufacturing?

Key trend identified:

- Value added for UK aerospace manufacturing experienced a fall between 2006 and 2015, followed by a partial recovery until 2021.

- A decrease of 14,000 employees was observed in 2020–21 for aerospace manufacturing.

- While productivity in aerospace manufacturing has increased slightly since 2012, productivity in MRO has deteriorated significantly.

- The UK has one of the highest aerospace trade surpluses among comparator countries.

Potential drivers identified from the literature review and consultations with sector experts (see Appendix 3.1 for details):

The aerospace market is typically cyclical and sensitive to global crises, with the cycles closely linked to global economic performance

- As suggested by the consulted stakeholders, the demand for air travel drives the demand for aircraft, and this can easily be disrupted by external events.

- For example, the demand for aircraft fell as a result of the 2001 global economic slowdown, further affected by events such as the conflict in the Middle East, the SARS crisis in Asia and the 9/11 terrorist attacks. Together, these events led to a slowdown in passenger air travel and a decline in UK aerospace output [House of Commons, 2005].

- The 2008 financial crisis generated a lower impact in UK aerospace manufacturing, potentially due to a combination of government support and historically large order books from the larger manufacturers [House of Commons, 2017].

- Data from civil aircraft manufacturers shows that both Boeing and Airbus had fewer aircraft deliveries during the COVID-19 pandemic, although this trend started to recover in 2021 [JADC, 2022]. In the case of Boeing, aircraft deliveries fell substantially in 2018 and 2019, following the suspension of deliveries of the 737MAX as the result of a series of safety concerns.

- The defence aerospace market is typically less cyclical than civil aerospace, with performance more closely linked to a country’s defence budget than its economy [House of Commons, 2005].

Long-term order and contract pipelines shape investment planning and add resilience to the sector

- A key point expressed by the consulted stakeholders, who differentiate between aerospace and other manufacturing sectors, is the clear visibility of the long-term order pipeline. In this regard, the backlog for global jet production increased by 645 to 14,060 between 2020 and 2021 [JADC, 2022].

- New aircraft orders commit original equipment manufacturers (OEMs) and their key suppliers to long-term contracts, providing companies across the supply chain with the certainty to invest and innovate in the long term [Make UK, 2019]. Timeframes for aircraft development and production are long as a result of the complexity and safety requirements of modern commercial aircraft, with only a few aircraft development programmes running for decades within OEMs [House of Commons, 2017].

Demand from a handful of mostly foreign-owned OEMs has a significant effect on the whole UK aerospace supply chain, while investment decisions are often made abroad

- As identified by the interviewees, the UK aerospace sector is dominated by clusters of companies that produce complex aircraft components for original equipment manufacturers (OEMs), both in the UK and overseas.

- A 2017 report by the House of Commons estimated that there were approximately 2,500 aerospace companies in the UK, 2,300 of which had fewer than 10 employees [House of Commons, 2017].

- Overall, UK aerospace manufacturers feed into Airbus, Boeing, Bombardier, GKN, BAE Systems and Leonardo for aircraft programmes, and Rolls-Royce for engines [Make UK, 2019].

- A key OEM for UK aerospace is Airbus, with an estimated contribution to the UK economy of £5.6 billion in 2021, working with more than 2,000 UK suppliers and supporting over 86,000 jobs across the supply chain [Airbus, 2022].

- Similarly, Boeing spent £1.4 billion with UK suppliers in 2014, supporting 12,700 jobs in the country, in addition to more than 2,000 direct jobs in early 2016 [Boeing, 2017].

- The consultees indicated that, given that many of the aerospace manufacturing firms based in the UK are foreign-owned, investment decisions are typically made in headquarters abroad (usually in France, Germany or the US).

UK aerospace exports are driven by the sector’s specialisation in engines and aircraft components such as wings

- As highlighted by the consulted stakeholders, the sector is highly export-intensive, with 59% of production exported (by value), the highest of any manufacturing sector [Make UK, 2019].

- The UK’s specialisation in engines and parts of aircraft is reflected in exports, accounting for 79% of all UK aerospace overseas sales in 2016 (with 35% of those parts being wings, fuselage, doors, control surfaces, landing gear and fuel tanks, 23% being turbojet engines and 20% engine parts) [Make UK, 2019].

- In contrast, 47% of the total supply into production was imported in 2014, highlighting the need for seamless trade in the sector [Make UK, 2019].

The recent fall in aerospace manufacturing employees is mostly related to COVID-19 company restructuring and supply chain consolidation

- The consulted stakeholders highlighted that companies such as Rolls-Royce and Airbus underwent restructuring associated with lower production levels during the COVID-19 pandemic in 2020–21, reportedly cutting 8,500 and 1,700 jobs, respectively [BusinessLive, 2021; BBC, 2020].

- OEMs seeking production efficiencies and cost reductions have started to outsource the development of entire sub-systems, as opposed to single components, in order to reduce the number of suppliers [Make UK, 2019]. Top-tier suppliers have consolidated the industry in recent years by offering manufacturing services that go from system to component level, largely eliminating the need for OEMs to seek out hundreds of suppliers to complete a new aircraft design [Partstat, 2018].

Highly specialised workforce know-how and closeness to world-leading R&D hubs anchor operations to the UK

- The consulted stakeholders suggested that, although there are some benefits to overseas production, high costs and the risk of losing accumulated know-how could act as a disincentive for moving operations abroad. The high levels of technological skill involved in aerospace manufacturing mean that companies often benefit from keeping their manufacturing sites located close to where they do R&D, helping to anchor production in the UK in the near future [House of Commons, 2017].

- Despite OEMs cutting jobs in response to external events, the impact on direct employment is potentially limited, as firms aim to retain their skills base and manufacturing capacity. For example, Airbus’ 2021 revenue was 30% below that realised in 2019, but its workforce was only 15% smaller [Airbus, 2022].

The UK MRO industry is expected to see growth in the coming years, despite pressures from European competitors

- The UK has the largest MRO market share in Europe by revenue, above France, Germany, Russia and the rest of Europe, with UK-based Rolls-Royce and BAE Systems among the top five MRO market players in Europe [Mordor Intelligence, 2023].

- The fleet age of major airlines such as Jet2, British Airways, Eastern Airways and Loganair (13.5 years, 13.6 years, 18 years and 23.4 years, respectively) is expected to generate demand for new aircraft-maintenance contracts [Mordor Intelligence, 2023].

- The key challenge for the UK MRO sector is to prepare and position attractively for the more technology-intensive aircraft, for example: increased use of composites; increased use of electrical power; introduction of health monitoring, diagnostic and prognostic technologies; and enhanced cabin environment and interiors [BIS, 2016].

A number of challenges/opportunities are driving policy and industrial strategies to ensure future aerospace sector growth

Market shift towards single-aisle aircraft

- The consulted stakeholders recognised the need for UK suppliers to respond to a market shift towards narrow-bodied, single-aisle aircraft. Single-aisle orders placed in the first 10 months of 2022 were the highest year-to-date figure for single aisles since 2014, with wide-body aircraft orders behind the pre-COVID level [ADS, 2022; Make UK, 2019].

Competition from emerging markets and highly productive advanced economies

- A 2016 government study reported that, based on data from prime contractors and major Tier 1 suppliers, the procurement spend in the UK grew by 1.4% from 2013 to 2014, compared to 5.2% for the rest of the world, signalling an increasing challenge from emergent competitors in lower-cost and developing economies [BIS, 2016].

- Examples of emerging competitors in the civil aerospace market include Chinese, Japanese and Russian efforts to develop regional jet programmes [House of Commons, 2005].

Domestic supply chain development

- To compete with low-cost emerging markets and highly productive advanced economies, continuous improvements and investments in quality and productivity are needed in order to benefit from new technologically evolved aircraft programmes [BIS, 2016].

- Although the UK is known for its competence in areas such as engines and aerostructures, areas of opportunity exist in the development of capabilities and skills for other supply chain segments [Make UK, 2019].

Trade restrictions, geopolitical issues and input cost pressure on margins

- As indicated by the consulted stakeholders, rising energy prices and the depreciation in sterling is putting significant upward pressure on manufacturers’ input costs and could put pressure on smaller companies that are less well positioned to absorb these increases.

- Geopolitical issues such as the Russia–Ukraine war could impact the purchase of raw materials and the sales of commercial airplanes. For example, the consulted stakeholders stated that the war in Ukraine has disrupted the supply chain of raw materials such as titanium.

- Competitors could try to encourage governments to find loopholes to raise the cost of production for UK businesses, for example, by removing EU exemptions for raw materials to raise the cost of production in the UK [Make UK, 2019].

What is driving business R&D expenditure trends in aerospace manufacturing?

Key trend identified

- UK business expenditure on aerospace R&D grew on average between 1990 and 2020

Potential drivers identified from the literature review and consultations with sector experts (see Appendix 3.1 for details):

The competitiveness of the UK aerospace manufacturing sector is underpinned by its advanced R&D and innovation capabilities

- As suggested by the consulted stakeholders and other sources, UK aerospace is a high-value sector driven by innovation. The ability to innovate has ensured the international competitiveness of the sector by staying at the forefront of technological development.

- Moving forward, the UK’s future competitiveness will depend on the sector’s ability to maintain a technological advantage in areas such as engines, wings and advanced systems. In addition, the UK is one of the few nations with the capabilities to design and build advanced helicopters [House of Commons, 2017].

The government has played a key role in supporting sectoral R&D, innovation and competitiveness

- Various government initiatives have been fundamental to maintaining competitiveness in the sector, including (non comprehensive list):

- The UK Aerospace Research and Technology (UKART) Programme, also known as the ATI Programme, founded in 2012–13 with a £3.9 billion joint government and industry investment to 2026 [ATI, 2021].

- The Aerospace Sector Deal (part of Industrial Strategy) focused on three grand challenges in the civil aerospace sector in December 2018 (i.e. artificial intelligence and data, clean growth and the future of mobility). The Industrial Strategy Challenge Fund committed a £125 million investment, backed by £175 million from industry, to support the Future Flight Challenge, aimed at exploring aircraft electrification and autonomy [BEIS, 2020].

- The Aerospace Growth Partnership (AGP) is a strategic partnership between the UK government, industry and other key stakeholders to tackle the barriers to growth through working groups focused on four main themes: UK aerospace strategy; manufacturing and supply chain competitiveness; sector skills; and engagement and communications. The AGP also supports the Sharing in Growth Programme, which has helped SMEs to secure contracts worth over £1 billion [Make UK, 2019].

Continuous government support is needed to seize the opportunities from emerging technology trends

- A key message from the expert consultations is that government support programmes are critical for manufacturers to increase their competitiveness, and continuous support is needed to capture the opportunities related to emerging technologies and net-zero targets.

- The consulted stakeholders suggested that, despite its strong international position, the sector could reinforce training/education for new skills requirements (e.g. data security, composite manufacturing and telecommunications) arising from the introduction of new technologies.

- Similarly, the interviewees suggested that government support and funding for late-stage product development and commercialisation could be boosted, although support for early-stage technological innovation is strong with the help of AGP and ATI.

Emerging market and technology trends have shaped the direction of innovation efforts in recent years

- The transition from fossil fuels to zero-carbon aircraft: The UK aerospace industry can seize nearly 18% of the global market for more energy-efficient commercial aircraft, potentially worth £4.3 trillion in 2050 [ATI, 2022b]. Sustainable aviation fuels (SAFs), electric batteries and hydrogen are three alternatives to fossil fuels that are being explored by the aviation industry to achieve its decarbonisation targets. Technologies relating to highly-efficient and lightweight aircraft and near-net-shape manufacturing are also key enablers of this target [ATI, 2022].

- Emergence of new aircraft segments: Drones for cargo or surveillance purposes, electric vertical take-off and landing (eVTOL) aircraft providing short journeys for fewer than 10 passengers, and regional air mobility providing short/medium trips for 10+ passengers are key emerging segments [ATI, 2022]. The ATI predicts that over the long term the conventional aircraft market will continue to retain the largest market share. However, this share is expected to gradually decline in volume and value with the electric aircraft, drone, eVTOL and regional air-mobility market growing. However, the consulted stakeholders suggested that the manufacturing of drones might not necessarily be conducted in the UK, as it is seen as a commoditised process.

- Digitalisation of manufacturing: Digitalisation could benefit the aerospace sector by supporting new product design and development and supply chain integration for manufacturing and MRO. For example, virtual certification can reduce the cost of new product development, and virtual reality (VR) technology helps engineers to verify the feasibility of the maintenance related to new product designs [Airbus, 2019].

- Space tourism: Despite being in its infancy, the commercial spaceflight market is expected to grow to £25 billion over the next 20 years. In 2017 the UK government announced that grants worth up to £10 million were being made available to help develop commercial launch capability for spaceflight to seize this opportunity [Make UK, 2019].