Reports and articles

Five reasons why Mexico needs an industrial innovation strategy now

Published on July 8th 2024

By Dr Carlos López-Gómez, Head, Policy Links, IfM Engage

With a robust manufacturing sector and a growing presence in global industries, Mexico is well positioned to enhance its economic standing. But to fully capitalise on this potential and transition to a more advanced economy, it is imperative that the country implement a national industrial innovation strategy.

Mexico has recently made significant strides in terms of economic development. The number of Mexicans living in poverty has fallen from 52 million to 47 million during the current administration, and this is likely to drop further in 2024, according to independent measurements. Having benefited from a global relocation of industrial investment, Mexico has surpassed China as the top US trading partner and is now the world’s eleventh-largest foreign direct investment (FDI) recipient in the world.

However, Mexico’s growing standing as a global industrial hub has not resulted in the kind of economic development and modernisation that the so-called Four Asian Tigers (Hong Kong, Singapore, South Korea and Taiwan) experienced in the 1960s. Mexico’s industries have largely continued to specialise in low value-added, highly labour-intensive and mostly poorly paid niches.

Mexico urgently needs a national industrial innovation strategy if the country is to transition to a more advanced economy. This strategy is required for five key reasons: to increase industrial sophistication; to respond to growing international competition; to drive industrial sustainability; to adapt to new technologies; and to fully exploit Mexico’s industrial and innovation potential. These five reasons are discussed below.

Reason #1: Manufacturing is critical to the Mexican economy, but it remains largely unsophisticated

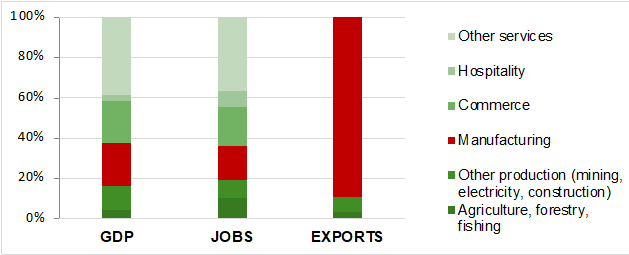

Manufacturing plays a critical role in Mexico’s economy (Figure 1). It represents over 20% of GDP and employs over 10 million workers, or just over 17% of Mexico’s total labour force. According to the World Bank, Mexico ranks seventh globally in manufacturing output. Despite the common image of Mexico as an oil-dependent economy, the value of manufactured exports is 16 times larger than that of oil exports. Today, Mexico is one of the largest exporters of cars and computers in the world.

Figure 1. Sectoral contribution to Mexico’s economy

Source: National Institute of Statistics and Geography (INEGI), author’s analysis

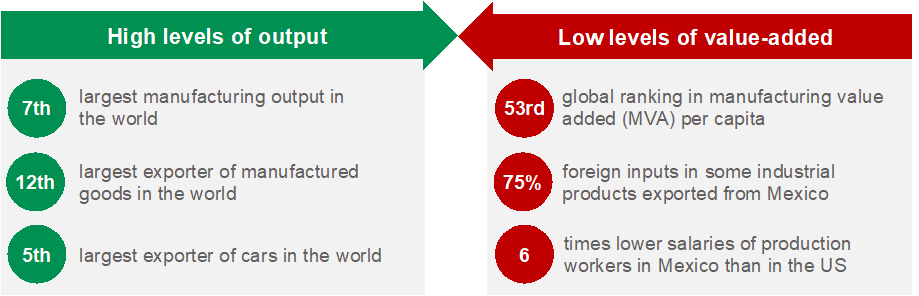

However, high levels of manufacturing output do not equate to high value-added production (Figure 2). Much of the manufacturing relies on imported components, and workers often earn significantly less than their counterparts in developed countries. Mexico ranks only 53rd globally in terms of manufacturing value added per capita, a measure of its manufacturing sophistication.

This matters because low-value production leads to low-paid jobs, making the sector vulnerable to relocations and heavily dependent on external technologies. Without a strategic push towards innovation, Mexico’s manufacturing sector risks being locked in the lower tier of global production systems.

Figure 2. Strengths and challenges of Mexican manufacturing

Source: World Bank and UNIDO, author’s analysis

Reason #2. As global competition increases, Mexico risks falling behind in the race for tomorrow’s industries

Countries worldwide are developing a new wave of industrial strategies to secure their positions in both established and emerging industries. These strategies include investments in R&D and infrastructure, as well as incentives to attract manufacturing FDI and expand domestic production capacity. The combined budget of over a trillion dollars announced as part of the US CHIPS and Science Act and the Inflation Reduction Act have caught the attention of policy-makers everywhere. But the United States is not alone.

The European Union has recently committed at least 600 billion euros to its European Green Deal initiative. China has already cemented its leadership in growing industries such as photovoltaics and electric vehicles, and it is a leading contender in areas such as 5G and biopharmaceuticals.

Countries in the ASEAN region such as Vietnam, Thailand and Malaysia are competing with Mexico for manufacturing investment. They are also establishing national industrial and innovation strategies and experiencing a surge in manufacturing growth due to the global diversification of supply chains away from China. Latin American peers such as Brazil are following suit.

Mexico faces significant challenges that are holding its industry back: inadequate energy and transport infrastructure in some regions; difficulty obtaining raw materials and other resources (including water); and specialist skills shortages. Without a national strategy to address these structural factors, foster innovation and enhance global competitiveness, the country risks falling behind its regional and global competitors, which are already putting ambitious strategies in place.

Reason #3. Innovation is critical to driving more sustainable industries

The global industrial sector is responsible for approximately 30% of carbon emissions and consumes 54% of the world’s energy sources. While manufacturing is crucial for the economy, achieving climate targets requires a significant reduction of industrial emissions. The urgency of action cannot be overstated – the process of industrial decarbonisation is becoming one of the major determinants of the long-term resilience of national economies.

Mexico faces multiple challenges in this regard. First, the ability to manufacture sustainably is increasingly a critical decision-making factor in firms’ investment decisions. To remain a competitive industrial location, Mexico must decarbonise its electric grid, enhance its monitoring of industrial pollution, and enforce sustainability standards.

Second, Mexico needs to promote the adoption of best-available green practices and sustainable industrial technologies. Technologies such as heat pumps, smart energy monitoring systems and energy-efficient electric vehicles are already mature but need to be rolled out at scale. While consumers everywhere are demanding greener products, companies face technical and financial barriers to a quick transition to more energy-efficient processes. Overcoming these barriers requires decisive policy action.

Finally, it is estimated that 60% of the technologies needed to achieve significant environmental mitigation, such as advanced batteries and hydrogen electrolysers, are not yet available at scale. Manufacturing these products in the future presents an opportunity for Mexico. In addition, Mexico needs to integrate into international innovation networks to keep abreast of technological developments, adapt technologies to the local context and promote early adoption.

Reason #4. Mexican industries must adapt to new technological advances or face a decline

The rapid pace of technological advancements poses both challenges and opportunities for manufacturing countries. As new technologies mature and are adopted, they change the dynamics of competition within industries and reshape the global value distribution. Not only might the countries’ products become obsolete, their installed production processes also need to be upgraded using new technologies in order to stay competitive.

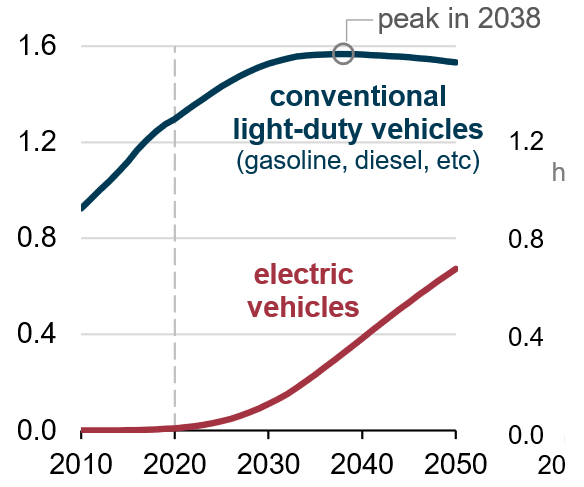

Take the automotive industry as an example. The International Energy Agency (IEA) anticipates that electric vehicles (EVs) will represent around one-quarter of all car sales by 2025, up from 18% in 2023 and 14% in 2022. Global EV sales are expected to grow in the foreseeable future (Figure 3). Some leading Mexican companies are already transitioning towards electrification. But if Mexico’s traditional automotive supply chain does not keep pace with these developments, and the country fails to attract next-generation investments, its automotive industry risks becoming obsolete.

Figure 3. Global vehicle stock

Source: U.S. Energy Information Administration.

The process of technological adaptation is complex. It requires not just investment in new technologies but also a comprehensive approach to integrating these technologies into existing factories. In Mexico, new public infrastructure will be needed, including modern research and development (R&D) facilities, innovation hubs and technology parks that can support collaborative efforts between academia, industry and government. Specialised logistics and supply chain infrastructure might be required. New training programmes will be essential to equip the workforce with new skills, involving vocational centres, universities and on-the-job training. Updated regulations might also be needed to ensure safety and compliance while encouraging experimentation and rapid technology deployment.

Reason #5. Mexico’s industrial and scientific capabilities have the potential to drive economic growth

Mexico boasts a strong industrial base, receiving record levels of foreign investment in sectors such as automotive, aerospace and machinery. In 2023 the Ministry of Economy reported an increase of 27% in foreign direct investment (FDI), reaching 36 billion dollars, 50% of which was in manufacturing. Mexico’s proximity to the US and membership of the United States-Mexico-Canada Agreement (USMCA) is a strategic advantage.

At around 0.3% of GDP, Mexico’s investment in its research and development is still much lower than the OECD average of 2.7% of GDP. This hinders the country’s ability to develop firms that compete through innovation rather than cheap labour.

Nonetheless, Mexico has developed a robust university system with leading public and private universities that attract talent from across Latin America. Mexico’s National System of Researchers, the country’s most recognised association of research professionals, has over 30,000 registered researchers. National public research centres have developed pockets of excellence in areas including chemistry, advanced materials and industrial engineering. High enrolment in science and technology (STEM) fields and international networks of Mexican expatriates further bolster the country’s scientific potential.

The president-elect’s recent announcement about the creation of a new Secretariat for Science, Technology, Humanities and Innovation signals a renewed recognition of the importance of innovation to the new administration. The challenge ahead for the new Secretariat is not only to promote more investment in R&D but, crucially, to foster long-term industrial competitiveness through strong connections between science and industry.

How to design an effective industrial innovation strategy

In the last few decades the Mexican government has not published any industrial or innovation strategies. Considering the challenges and opportunities discussed above, a robust industrial innovation strategy could serve as a tool to outline how Mexico can compete on a global scale, attract foreign investment and secure its place in the future industrial landscape.

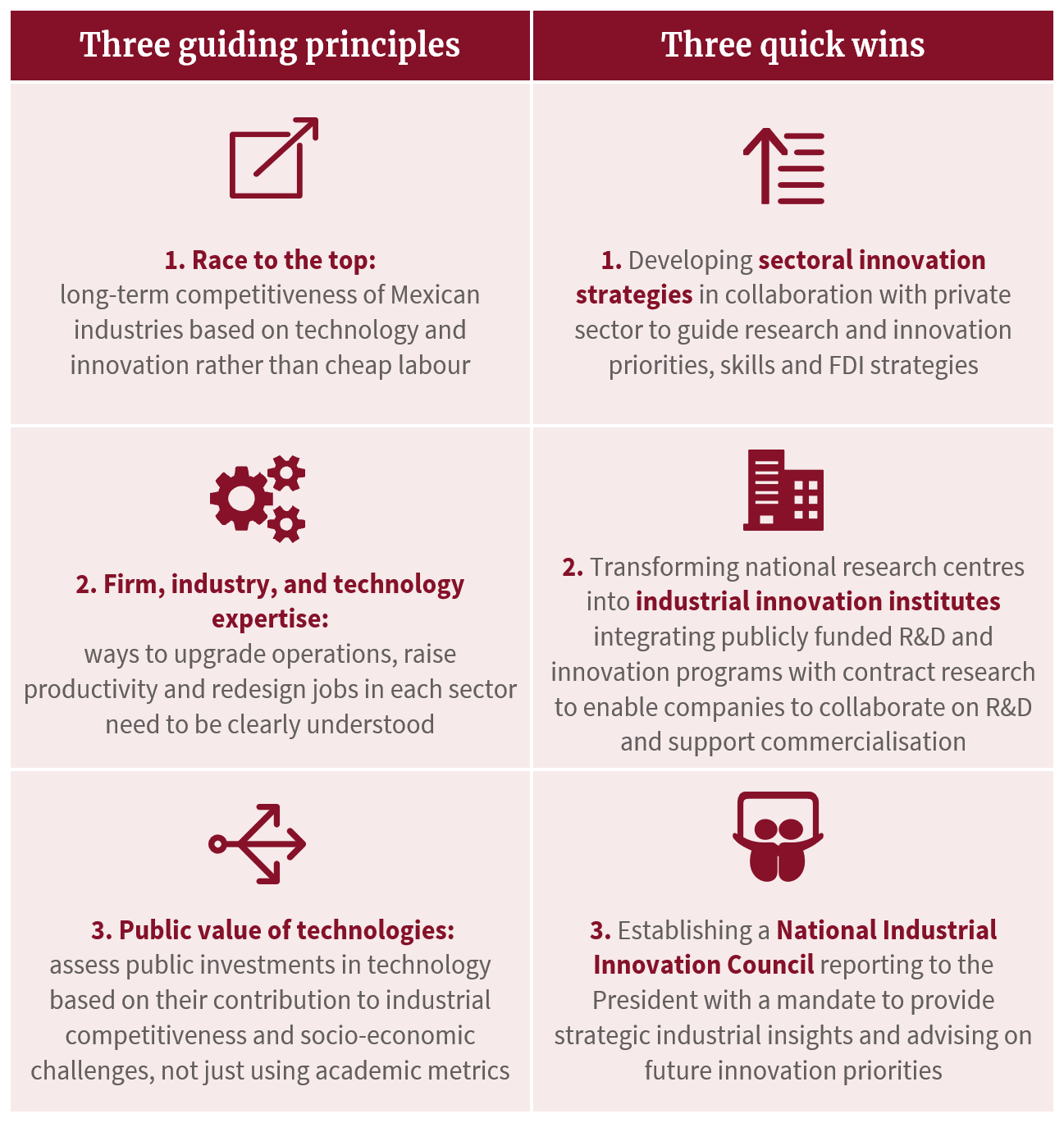

Figure 4. How to design and effective industrial innovation strategy

Three guiding principles

What should Mexican policy-makers consider, and what should the main priorities be? How can multiple legitimate interests be considered? There is no universal approach to achieving this that works regardless of context. However, three guiding principles can be elicited from international experience.

- Engage in a “race to the top”: An effective strategy should focus on long-term competitiveness through technology and innovation. Mexico should enhance its global competitiveness, not by keeping labour costs down but by leveraging new technologies. Emphasising technology and innovation will help Mexican industries to move up the value chain, reduce dependency on low-wage labour and compete effectively in the global market.

- Incorporate firm, industry and technology expertise. Different sectors of the economy require varying degrees of government support and collaboration. Rather than relying on simplified economic models of growth, specific challenges and opportunities within each sector should be clearly characterised, identifying ways to upgrade operations, raise productivity and redesign jobs.

- Prioritise the public value of technologies. A common mistake is to think of technology as the realm of academics and that technology investments should be judged using academic metrics. However, public investments should prove valuable to society; as such, it is necessary to assess the extent to which public investments in technology boost the competitiveness of domestic industries and generate well-paid jobs. Technology should also be leveraged to address the pressing socio-economic issues facing Mexico. For instance, innovation in clean water technologies, precision agriculture tools and smart transportation systems can significantly improve quality of life and economic stability.

Three quick wins

To jumpstart implementation of the strategy, Mexico can take three immediate actions:

- Develop sectoral innovation strategies. The first step involves creating tailored innovation strategies for key Mexican industries. These strategies should not only prioritise research and innovation but also encompass broader initiatives to develop new skills, attract foreign direct investment (FDI) and guide infrastructure decisions. A notable example is Singapore’s Industry Transformation Maps, which cover 23 industries representing 80% of the country’s GDP. These maps represent comprehensive sector-focused strategies aimed at sustaining economic growth and competitiveness.

- Transform national research centres into industrial innovation institutes. A significant gap in Mexico’s innovation ecosystem is the absence of dedicated intermediary organisations that bridge scientific knowledge and industry needs. While long-term investment in basic research within the university system is crucial, converting research centres currently funded by the National Council of Humanities, Sciences and Technologies (CONAHCYT) into industrial innovation centres could be achieved in a shorter time frame. These centres could integrate publicly funded R&D and innovation programmes with contract research, enabling companies to collaborate on research and development and supporting commercialisation efforts. International models include the Manufacturing USA institutes in the United States and the Catapult Centres in the United Kingdom, both inspired by Germany’s Fraunhofer model.

- Establish a National Industrial Innovation Council. Another short-term action would be to establish a national council reporting directly to the president. This council could be convened by the new Secretariat for Science, Technology, Humanities and Innovation and tasked with providing strategic industrial insights and advising on future innovation priorities. The council should comprise representatives from government, industry, academia and civil society to ensure a holistic and coordinated approach to industrial innovation. Responsibilities could include monitoring global trends, evaluating the effectiveness of current policies, and recommending strategic adjustments to keep Mexico at the forefront of industrial innovation. International examples include Japan’s Council for Science, Technology and Innovation and Canada’s Advisory Council on Economic Growth.

An industrial innovation strategy could help Mexico to compete globally, foster sustainable industrial practices, adapt to technological changes, and leverage its unique industrial and scientific potential. Such a strategy should be established as a matter of national priority to help Mexico transition to a more advanced economy.

You can also read Cambridge Industrial Innovation Policy’s analysis of China and Brazil’s recent industrial policy plans.

For further information please contact:

Carlos López-Gómez

+44 (0) 1223 764657cel44@cam.ac.ukConnect on LinkedInDownload the Policy Brief

News | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

3rd February 2026

The Swiss paradox: a services reputation built on an industrial and innovation powerhouse

News | 21st January 2026

CIIP delivers bespoke training for delegation from the Government of Nigeria

Get in touch to find out more about working with us