Reports and articles

Making nearshoring work for Mexico: the role of industrial innovation policy

Published on October 15th 2024

By Dr Jennifer Castañeda-Navarrete and Derian Aranda-Aranda

This blog is also available in Spanish/Este artículo también está disponible en español.

Heightened geopolitical tensions, supply chain disruptions, and rising production costs in emerging economies have prompted businesses to relocate operations to neighbouring countries (nearshoring) and allied nations (friendshoring). Mexico is among the primary beneficiaries of this trend. In 2023, the country ranked 9th globally in terms of foreign direct investment (FDI) inflows and 5th among OECD countries. Additionally, for the first time in two decades, Mexico became the United States’ largest trading partner.

Despite these positive developments, Mexico has historically struggled to translate FDI flows into inclusive and sustainable development. As the country transitions under a new federal administration, there are opportunities for adopting a more strategic approach. In her inaugural address, President Claudia Sheinbaum Pardo committed to leverage the nearshoring trend to promote regional development and advance environmental sustainability.

In this article, we examine recent trends in nearshoring in Mexico and the challenges the country faces in capitalising the opportunities that these investments represent. In our recent policy brief, we argue for the implementation of national and regional industrial innovation strategies —government-led initiatives aimed at fostering innovation-driven competitiveness across sectors.

Showcasing our policy brief in action, we present a recent collaboration with the United Nations Industrial Development Organization (UNIDO), where Cambridge Industrial Innovation Policy assisted the Government of the State of Tabasco in developing a long-term industrial innovation strategy.

The rise of nearshoring in Mexico

Since the 2010s, global value chains have undergone significant restructuring, partially reversing the previous trend towards offshoring. This shift has intensified in recent years, driven by escalating geopolitical tensions, supply chain disruptions, adverse impacts of offshoring on innovation and inequality, and rising labour costs in major manufacturing countries, such as China.

The trends of nearshoring and friendshoring have become increasingly evident in trade and investment data since 2022. For instance, a report published earlier this year by the United Nations Conference on Trade and Development’s (UNCTAD) highlighted growing trade concentration and trade between political allies, measured by their United Nations voting patterns, since late 2022.

In the North American context, the United States-Mexico-Canada Agreement (USMCA), which came into effect in 2020, has played a pivotal role in nearshoring decisions. This agreement introduced higher regional value content requirements for products to qualify as “made in North America”, thereby incentivising producers to relocate their supply chains within the region.

Following the signing of the USMCA, multiple high-level meetings between the three signatory countries, as well as bilateral discussions between Mexico and the United States, have sought to strengthen Mexico’s role in manufacturing value chains. These dialogues have placed particular emphasis on strategic sectors such as semiconductors and medical devices.

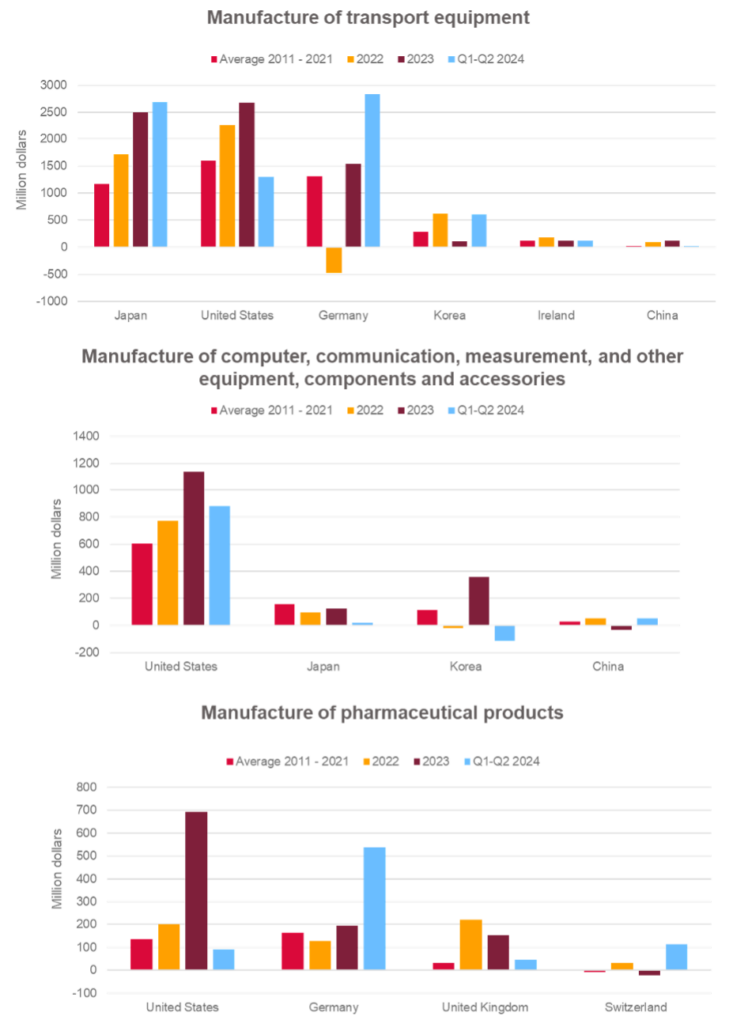

Mexico’s proximity to the United States, its political alignment, and the incentives established by the USMCA have positioned it as a key beneficiary of production relocation closer to the US market. This trend is particularly pronounced in specific industries such as automotive, the manufacturing of computer, communication, and measurement equipment, and pharmaceuticals.

As Figure 1 illustrates, leading investor countries —such as the United States, Japan, Germany, Korea, the United Kingdom, and Switzerland— have increased their investments in these industries in Mexico, particularly during 2023 and the first half of 2024. Although concerns have been raised in the United States about potential exploitation of USMCA preferences by Chinese companies, Chinese FDI accounted for less than 1% of the total FDI received by Mexico over this period.

FIGURE 1. FDI TRENDS IN MEXICO: TOP INVESTOR COUNTRIES IN KEY INDUSTRIES

Source: Mexico’s Ministry of Economy (2024). Inversión Extranjera Directa en México por país de origen, sector, subsector y rama.

The role of national and sub-national industrial policy

Overall, Mexico has struggled to leverage FDI for inclusive and sustainable development, prioritising cost competitiveness over the fostering of innovation and value creation. While this approach has generated jobs, these tend to be low-quality positions and have limited the development of domestic technological capabilities.

Although aerospace, automotive, electronics, and medical devices clusters have emerged in the northern, central, and western regions over the past few decades, their impact on economic development has been limited. Most of these clusters are led by transnational companies and are concentrated in segments of the value chain characterised by low productivity, low technological sophistication and minimal links with local suppliers.

In response to the growing nearshoring trend, the Mexican government has introduced several measures aimed at attracting FDI, including streamlined processes for investors, infrastructure investment, and tax incentives in priority sectors such as electronics, semiconductors, medical equipment, and automotive components. However, a more comprehensive approach—through long-term industrial strategies at both federal and state levels—is required to fully capitalise on this unique opportunity for sustainable and inclusive industrial growth.

The recent surge in FDI is deepening existing regional inequalities within Mexico. While the highly industrialised northern, central, and western regions have been the primary beneficiaries, the southern states—aside from Yucatán—have experienced limited momentum.

The Polos de Desarrollo para el Bienestar programme, which focuses on developing industrial hubs in some of the least developed areas of the country, aims to narrow some of these gaps. This initiative offers significant tax benefits, such as exemptions from VAT and income tax for the initial years of operation, alongside administrative support for companies establishing operations within these hubs.

However, aligning infrastructure development with a long-term vision is critical to ensuring that investments translate into broader economic and social gains for all, including underserved groups and less developed regions. Measures in this direction may include the development of lifelong learning programmes, strengthening vocational and technical education, fostering technology transfer and domestic innovation, enhancing the provision of business advisory services, developing supplier development programmes, business support programmes targeted at women and other underserved groups, and enforcing conditionalities for FDI and business support in strategic sectors.

An industrial innovation strategy can provide coherence across these measures, ensuring that all initiatives are aligned with a unified vision for the future that prioritises inclusive and sustainable development. Moreover, consultative processes that incorporate diverse perspectives can foster consensus on key priorities and long-term goals and align interests across different stakeholders.

A strategic blueprint: Tabasco’s long-term industrial plan

In light of these challenges, Cambridge Industrial Innovation Policy, in collaboration with the United Nations Industrial Development Organization (UNIDO), supported the Government of the State of Tabasco in developing the Strategic Plan for the Industrial Development of the State of Tabasco 2024-2044. This plan sets a long-term vision for sustainable and inclusive industrial development over the next two decades, identifies priority sectors, and outlines strategic projects, policy areas and measurable goals to guide the state’s industrial transformation.

The challenge

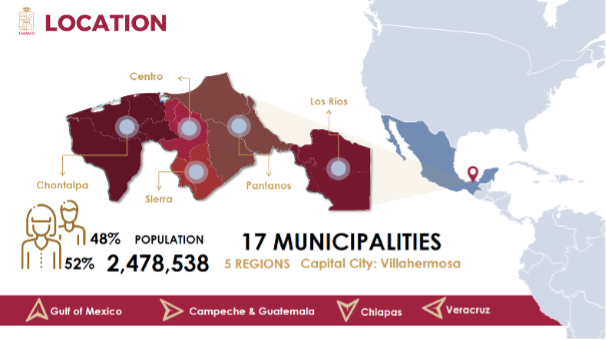

The state of Tabasco, situated in southeastern Mexico along the Gulf of Mexico, offers a strategic position for nearshoring, thanks to its proximity to key markets, access transportation routes, and industrial capabilities (Figure 2). Its abundant natural resources, including water, fertile soils, and oil reserves, have fostered the growth of industries such as petrochemicals and agribusiness. However, this reliance on a few sectors has limited economic diversification and innovation, and contributed to widening regional inequalities within the state.

FIGURE 2. LOCATION OF TABASCO, MEXICO

Source: Government of Tabasco (2023). Tabasco Strategic Destination.

Tabasco’s manufacturing sector remains underrepresented when compared to its share in the national economy. This productive pattern is evident in the workforce’s concentration in low value-added services, characterised by less competitive wages. Additionally, the contribution of Tabasco’s micro, small, and medium-sized enterprises (MSMEs) to overall production and investment lags behind the national average, further constraining the state’s economic dynamism.

These challenges are exacerbated by global trends, including climate change, the digital transition, intensifying global competition, and the reconfiguration of global value chains. In this context, Tabasco faces the urgent need to shift towards a more diversified, inclusive and innovation-driven industrial base to remain competitive and sustainable in the long term.

Our approach

In assisting the development of the Strategic Plan for the Industrial Development of the State of Tabasco 2024-2044 we drew upon three key sources of evidence:

- Statistical and documentary analysis. This involved reviewing existing studies and databases to understand Tabasco’s capacities and opportunities for industrial development. We conducted a comprehensive analysis of the state’s productive, innovation, policy, and governance capacities, as well as a gender analysis. Additionally, we examined trends, strengths, weaknesses, opportunities, and threats across key sectors. The primary outcome of this work was the Diagnosis of Capacities and Opportunities for Long-Term Industrial Development of the State of Tabasco.

- We engaged in consultations that included targeted evidence requests, interviews with key stakeholders, an online sector prioritisation workshop, and three roadmap workshops focusing on agroindustry, the chemical industry, and renewable energy. Insights from these consultations were integrated into the aforementioned Diagnosis and in a roadmap report.

- Review of national and international practice. Annex B of the Plan provides a review of best practices from both national and international contexts. This review covers export and investment promotion agencies, industrial innovation programmes, eco-industrial clusters, and industrial advisory boards. It includes examples from Mexican states such as Estado de México, Guanajuato, Nuevo León, Querétaro, San Luis Potosí, and Sinaloa, as well as international case studies from Chile, Colombia, the Dominican Republic, the Netherlands, and Singapore.

The Strategic Plan

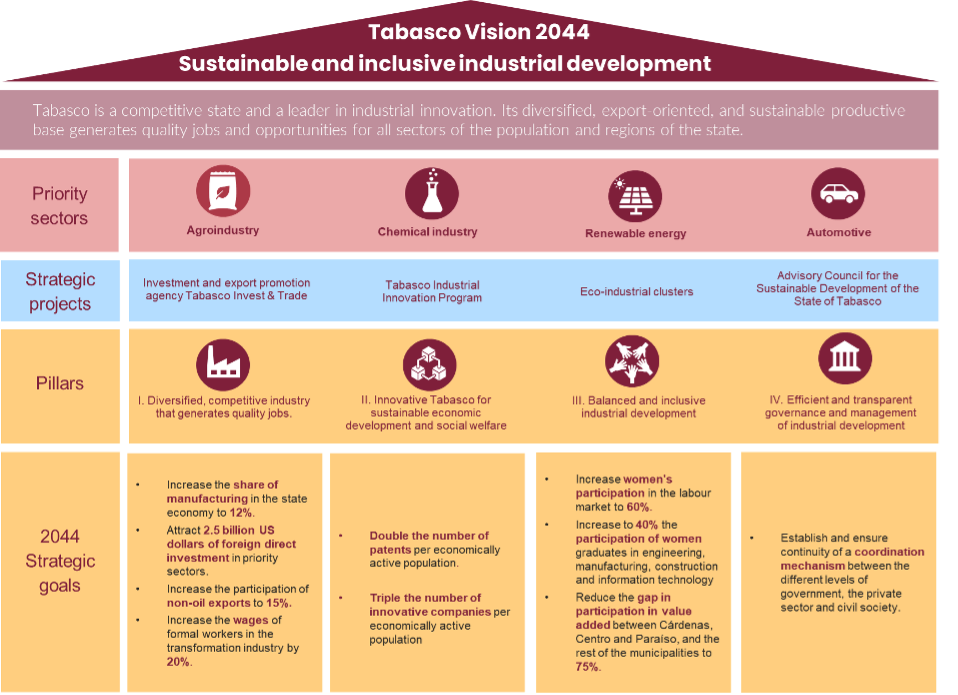

The Strategic Plan for Industrial Development of the State of Tabasco 2024-2044 reflects the consensuses reached among key local stakeholders from diverse productive sectors. This collaborative effort has defined Tabasco’s vision for 2044:

Tabasco is a competitive state and a leader in industrial innovation. Its diversified, export-oriented, and sustainable productive base generates quality jobs and opportunities for all sectors of the population and regions of the state.

The Plan is structured around four pillars, four strategic projects, and four priority sectors as Figure 3 shows. Each of these priority sectors, along with the four pillars, has its own roadmap detailing specific actions and initiatives designed to achieve the Vision 2044 for the State of Tabasco.

The four pillars for sustainable and inclusive industrial development in the State of Tabasco are:

- Diversified, competitive industry that generates quality jobs. This pillar focuses on developing productive skills, expanding the manufacturing base, and integrating micro, small, and medium-sized enterprises into global and national production chains.

- Innovative Tabasco for sustainable economic development and social welfare. This pillar aims to strengthen the collaboration between industry and academia, as well as to incentivise applied research and development and technology transfer.

- Balanced and inclusive industrial development. This pillar ensures that industrial development follows a sustainable and inclusive development approach to reduce regional and gender gaps.

- Efficient and transparent governance and management of industrial development. This pillar seeks to enhance governance and management capacities to deliver an efficient and inclusive industrial policy and establish coordination mechanisms with the stakeholders involved in industrial activity.

Tabasco’s industrial diversification requires a strategic approach that prioritises sectors with the most significant potential to add value to the state’s productive vocations. With this objective, and through a participatory process, a sector prioritisation exercise was carried out, identifying four priority industries: (i) Agroindustry, (ii) Chemical industry, (iii) Renewable energy, and (iv) Automotive.

This targeted approach aims to leverage Tabasco’s strengths and drive sustainable economic growth, ensuring that the benefits of industrial development are equitably distributed across all sectors, regions, and population groups within the state. Find out more about the State of Tabasco.

FIGURE 3. OVERVIEW OF THE STRATEGIC PLAN FOR INDUSTRIAL DEVELOPMENT OF THE STATE OF TABASCO 2024-2044

Source: Government of Tabasco (2024). Strategic Plan for the Industrial Development of the State of Tabasco 2024-2044, p. 5.

At Cambridge Industrial Innovation Policy, we work with governments and international development actors to inform the design and implementation of industrial innovation policies. We base our work on the latest academic thinking and international best practice. We combine these with careful study of the specific contexts, in collaboration with local partners, to identify sound and practical policy options. Find out more about working with us.

For further information please contact:

Jennifer Castañeda-Navarrete

+44(0)1223 766141jc2190@cam.ac.ukConnect on LinkedInNews | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

3rd February 2026

The Swiss paradox: a services reputation built on an industrial and innovation powerhouse

News | 30th January 2026

Gender-responsive industrial policies: webinar shares practical approaches for policymakers

Get in touch to find out more about working with us