Reports and articles

Understanding industrial Scope 3 emissions: what, why, how

Published on March 26th 2024

Although initially seen as secondary by most corporate-level standards, Scope 3 is now an important focus for corporations in the push to net zero, as new evidence points to its significance.

In this blog, Cambridge Industrial Innovation Policy’s Dr David Leal-Ayala explores the meaning of Scope 3, its relevance, and how businesses can approach this challenge. He draws from the White Paper: ‘The “No-Excuse” Opportunities to Tackle Scope 3 Emissions in Manufacturing and Value Chains’ published by the World Economic Forum’s Industry Net Zero Accelerator Initiative.

More than two decades ago, the Greenhouse Gas Protocol (GHG Protocol) defined emissions scopes as a way of classifying carbon sources. According to the GHG Protocol, Scope 3 emissions encompass all indirect emissions not included in Scope 2, which occur throughout the value chain of the company reporting them, including those from upstream and downstream sources.

In other words, most of a business’s Scope 3 emissions are the Scope 1 and 2 emissions of another business/individuals. While these emissions are not fully under a firm’s control, that firm may be able to affect the activities that result in them, influence its suppliers and/or choose which suppliers to engage with.

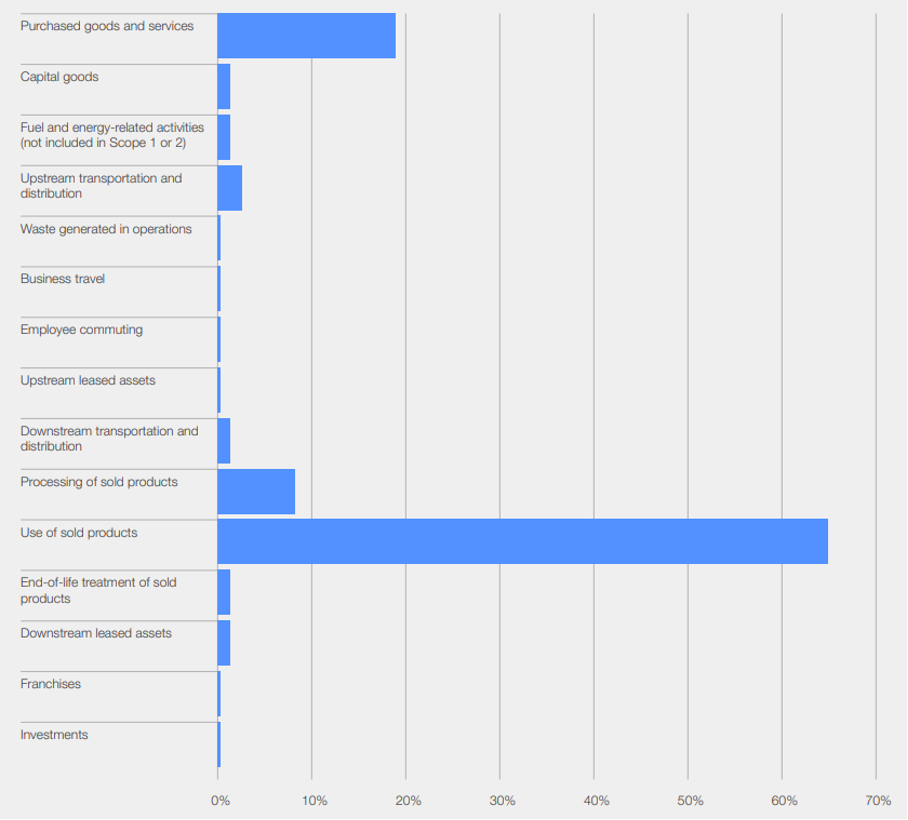

The GHG Protocol corporate standard classifies Scope 3 emissions into 15 different categories, as shown in Figure 1. Although not all categories are relevant to every organisation, these provide a structured framework to understand, measure, report and monitor Scope 3 sources of emissions across a value chain.

Figure 1. Source: Extracted and modified from World Economic Forum, The “No Excuse” Framework to Accelerate the Path to Net-Zero Manufacturing and Value Chains, White Paper, January 2023, and The GHG Protocol, Corporate Value Chain (Scope 3) Accounting and Reporting Standard, 2011.

Why does Scope 3 matter?

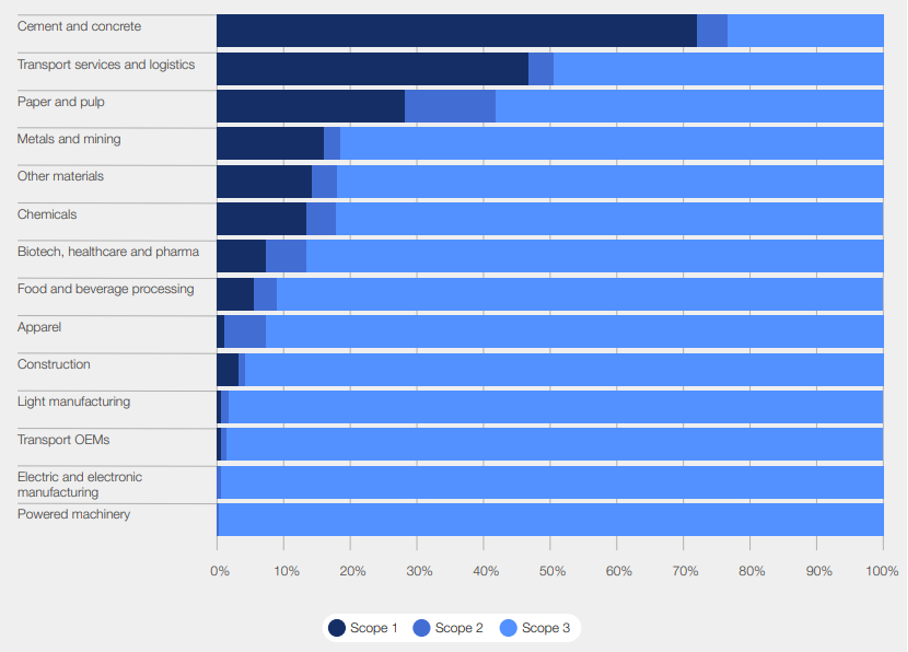

Scope 3 emissions can account for more than 70% of a business’s carbon footprint based on data from the UN Global Compact. Figure 2 highlights that different industries face different Scope 3 situations and challenges.

While industries such as cement and concrete, and transport services and logistics have relatively lower Scope 3 emissions, this category becomes significant for other industries, including chemicals, electronics, automotive and food, and as a result any decarbonization efforts in those sectors are likely to require intense cooperation among original equipment manufacturers (OEMs), consumer brand companies and their suppliers.

Figure 2. Source: Extracted from CDP and Capgemini Invent, From Stroll to Sprint: A Race Against for Corporate Decarbonization, July 2023; CDP, CDP Technical Note: Relevance of Scope 3 Categories by Sector, 2022.

Based on CDP data, Scope 3 category 1 (purchased goods and services) and Scope 3 category 11 (use of sold products) combined represent 84% of reported Scope 3 emissions (see Figure 3). However, reporting is often incomplete, with many industries omitting several Scope 3 categories. As indicated by the CDP, only 16% of organisations were able to share details of their supply-chain engagement strategy, while only 11% could do so for their portfolio of low-carbon products and services.

Figure 3. Source: Extracted from CDP and Capgemini Invent, From Stroll to Sprint: A Race Against for Corporate Decarbonization, July 2023; CDP, CDP Technical Note: Relevance of Scope 3 Categories by Sector, 2022

How is Scope 3 calculated and reported?

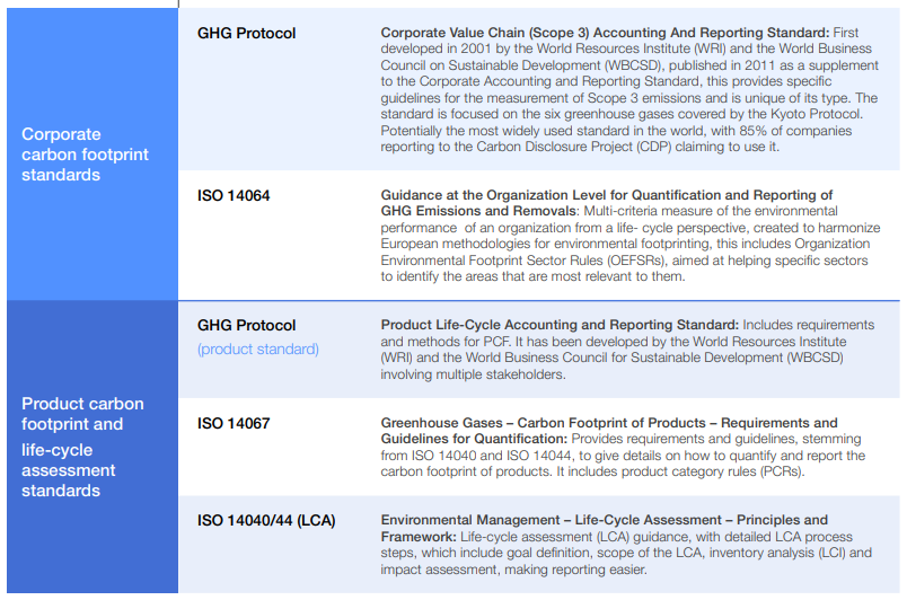

Carbon accounting standards underpin the measurement and reporting of carbon emissions as well as the tracking of organisational performance against abatement strategies and targets. Carbon accounting standards can be classified into two main categories:

- Corporate carbon footprint (CCF): CCF is the total sum of GHG emissions directly or indirectly generated by a company’s activities during a specific period of time.

- Product carbon footprint (PCF) and lifecycle assessment (LCA): PCF is the total GHG emissions generated by a product from the extraction of its necessary raw materials to its end of life. LCA studies the environmental aspects and potential impacts throughout a product’s life cycle, from raw materials acquisition through to production, use and disposal.

The variety of standards available makes it challenging for organisations to select the right one and ensure comparability of results across firms and sectoral, regional, and national aggregation. Figure 4 shows the most common standards used to evaluate CCF and PCF.

Figure 4. Note: The standards in each section are listed in alphabetical order.

Source: High Value Manufacturing Catapult, Embodied Emissions and Net Zero, 2022

Other CCF standards include the EU Organisation Environmental Footprint (OEF) as well as the Global Reporting Initiative (GRI) and Department for Environment, Food & Rural Affairs (DEFRA) guidance (UK). Additional PCF standards include the EU Product Environmental Footprint (PEF), BP X30–323 in France, and Publicly Available Specification (PAS) 2050.

To estimate emissions, companies use formulas to multiply the volume of their activities (e.g. purchased materials, transport) with emission factors (EF), which are representative values that attempt to relate the quantity of a pollutant released into the atmosphere with the activity releasing the pollutant. Finding the right EF is not an easy task because it is necessary to ensure its geographic relevance, its scale of application (national/regional or site-specific) and that it is well documented. Several public and private EF databases exist and should be selected depending on their application, as they use either generic or geographic/sector driven emissions estimates.

Examples of recognised EF databases include:

- GHG Protocol emissions factors databases

- Intergovernmental Panel on Climate Change (IPCC) Emission Factor Database (EFDB)

- Institute for Global Environmental Strategies (IGES) List of Grid Emission Factors

- World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) Greenhouse Gas Protocol Calculation Tools

- US EPA Air Pollutant Emission Factors AP-42 – Life-cycle databases (e.g. ecoinvent)

Why must companies measure Scope 3 emissions?

Although current Scope 3 standards push for voluntary disclosure, this might change in the future, as governments and organisations are increasingly pushing for mandatory disclosure as a basis for climate action planning.

Scope 3 reporting has garnered increasing significance in light of new regulations such as:

- The EU Corporate Sustainability Reporting Directive (CSRD) is a pivotal European Union directive aiming to standardise sustainability reporting practices among large companies and listed Small and Medium Entreprises (SMEs) operating within the EU. It significantly expands the scope of reporting by requiring companies to disclose detailed information on environmental and social matters, including Scope 3 emissions. This directive came into place on January 5th, 2023, with the first companies having to apply the new rules for the first time in the 2024 financial year, for reports to be published in 2025.

- The International Sustainability Standards Board (ISSB) is a standard-setting body under the International Financial Reporting Standards (IFRS) Foundation, whose mandate is the creation and development of sustainability-related financial reporting standards to meet investors’ needs for sustainability reporting. ISSB’s work is underway to develop sustainability disclosure standards, including on Scope 3 GHG Emissions, backed by the G7, the G20, the International Organization of Securities Commissions (IOSCO), the Financial Stability Board, African Finance Ministers and Central Bank Governors from more than 40 jurisdictions. Although not a mandatory, the new ISSB standard aims to significantly improve carbon accounting harmonisation – including sectoral specifics – to allow investors to take more informed green funding decisions.

Both these initiatives underscore the growing importance of holistic, comparable and auditable reporting to drive sustainability efforts and meet the increasing demand for transparency in the business world

How are companies reducing Scope 3 emissions today?

Organisations around the world are implementing a range of approaches and actions to reduce their Scope 3 emissions. Table 1 below shows selected examples of actions to reduce Scope 3 emissions, as suggested in the GHG Protocol Scope 3 Standard:

| Scope 3 category | Example |

| 1. Purchased goods and services |

|

| 2: Capital goods |

|

| 3. Fuel- and energy-related activities (not included in scope 1 or scope 2) |

|

| 4. Upstream transportation and distribution |

|

| 5. Waste generated in operations |

|

| 6. Business travel |

|

| 7. Employee commuting |

|

| 8. Upstream leased assets |

|

| 9. Transportation and distribution of sold products |

|

| 10. Processing of sold products |

|

| 11. Use of sold products |

|

| 12. End-of-life treatment of sold products |

|

| 13. Downstream leased assets |

|

| 14. Franchises |

|

| 15. Investments |

|

Table 1. Source: The GHG Protocol, Corporate Value Chain (Scope 3) Accounting and Reporting Standard, 2011.

A practical roadmap for businesses

There is no shortage of challenges to reducing Scope 3 emissions, and both SMEs and industry giants struggle to navigate the complexities involved in this task.

However, through extensive research and consultations with industry leaders and academic experts, the World Economic Forum’s Industry Net Zero Accelerator initiative identified 12 opportunity areas to help companies in their decarbonisation journey, and these, grouped into four action levels, serve as a guide to inform strategic decisions.

Details of these opportunities can be found in the White Paper: ‘The “No-Excuse” Opportunities to Tackle Scope 3 Emissions in Manufacturing and Value Chains’ which serves as a practical roadmap for businesses navigating the intricate terrain of Scope 3 decarbonisation and accelerating their contributions to global climate efforts.

For further information please contact:

David Leal-Ayala

+44(0)1223 764908drl38@cam.ac.ukDownload the report

The World Economic Forum’s Industry Net Zero Accelerator Initiative

This blog draws from the White Paper ‘The “No-Excuse” Opportunities to Tackle Scope 3 Emissions in Manufacturing and Value Chains’, published by the World Economic Forum’s Industry Net Zero Accelerator Initiative and co-authored by CIIP’s David Leal-Ayala.

The White Paper is part of a series of activities aimed at helping businesses collaborate and speed up the change across industrial sectors. It highlights emerging opportunities and best practices to inspire leaders in both private and public sectors to take action and drive the net-zero transformation of global supply chains without any excuses.

The World Economic Forum launched the Industry Net Zero Accelerator initiative in 2022 in partnership with knowledge partners Cambridge Industrial Innovation Policy and Capgemini, Rockwell Automation, and Siemens. It also involves a community of over 30 global manufacturing companies to help accelerate the industry’s transition to net zero. The initiative provides a platform for a growing community of industry leaders, technology providers, and academic experts to encourage knowledge sharing and actionable solutions towards achieving net zero.

Related resources

News | 6th February 2026

UK Manufacturing Dashboard: latest performance and global benchmarks

3rd February 2026

The Swiss paradox: a services reputation built on an industrial and innovation powerhouse

News | 21st January 2026

CIIP delivers bespoke training for delegation from the Government of Nigeria

Find out more about how our community supports governments and global organisations in industrial innovation policy